Mortgage Interest Rates Review

United Mortgage Nation 3/18/2025

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.799 | 5.999 | 6.125 | 4.069 | 6.875 | 6.875 |

| A month ago | 6.799 | 5.999 | 6.125 | 4.521 | 6.799 | 6.799 |

| Last week | 6.625 | 5.625 | 5.999 | 4.199 | 6.625 | 6.625 |

| This week | 6.500 | 5.750 | 5.999 | 4.279 | 6.625 | 6.625 |

Federal Fund Rate: 4.25 -4.50% Prime Rate: 7.25 – 7.50%

Rent in Queens, NY hit the Record

퀸즈 렌트 역대 최고치 기록

Korea Daily 3/18/25(Tue)

- According to MNS’s recent reports, average rent reached $2,929 which is up 4.62% from a year ago, $2,800, and up 0.92% up from the last month.

- Average rent for Studio unit in Queens was $2,401, up 4.33% from the previous year ($2,301). Among Queens areas, especially rent in Woodside and Maspeth went up 24.4% to $2,807 in March from $2,256 in Feb.

- Average rent for 1 bedroom unit in Queens was $2,831 which is up 4.7% from $2,703 last year. Especially average rent in Astoria area was $3,133, up 16.17% from $2,697 in Feb.

- Average rent for 2 bedroom unit was $3,555, up 4.74% from $3,394 last year.

Bergen clings to Blue Laws, established in 1704

버겐 카운티(NJ) “불루 법” 고수

Suburbanite 2/27/25(Thu)

- Decades after the rest of New Jersey ended the practice, Bergen County continues to enforce blue laws that ban most retail activity on Sundays.

- While critics call blue laws antiquated and inconvenient, local politicians and voters have repeatedly resisted to attempts to repeal them. During the last countywide referendum, in November 1993, voters rejected lifting the Sunday retail ban by a ration of 2-to-1.

- This law, dating to colonial times, based n Christian tradition and backed by local ordinances in Paramus, still prohibit the sale of nonessential items such as clothing and furniture, but include exceptions for services such as supermarkets and pharmacies.

- Officials in Paramus recently said they are considering legal action against American Dream, accusing the Meadowlands megamall of violating the county’s blue laws by allowing retail stores to operate on Sundays.

The SALT Deduction Cap is set to Expire. Start Planning Now

SALT 공제 한계 법령 만료가 다가오면서, 준비해야

WSJ 3/10/25(Mon)

- As Congress debates tax policy this year, state and local tax- deduction cap is in the crosshairs. The SALT deduction cap is set to expire at year’s end.

- Currently, households that itemize may deduct up to $10,000 of property, sales or income taxes paid to state and local government.

- If cap is modified, which is the likeliest outcome, how much it is adjusted matters. For highest tax bracket– currently 37% — the SALT cap of $10,000 means a decrease of $3,700 on a tax bill. If the limit increases to $20,000, that would decrease the tax payer’s bill by $7,400.

- If SALT cap is expired, the tax payers should watch the policy effective date since state, local and property tax are deducted in the year paid, which may differ from the year when they were assessed.

- If SALT limit becomes permanent, tax consulting might be needed.

Falling Stocks Threaten to Slow Economy

주가 하락이 미 경기 둔화를 초래할수…

WSJ 3/17/25(Mon)

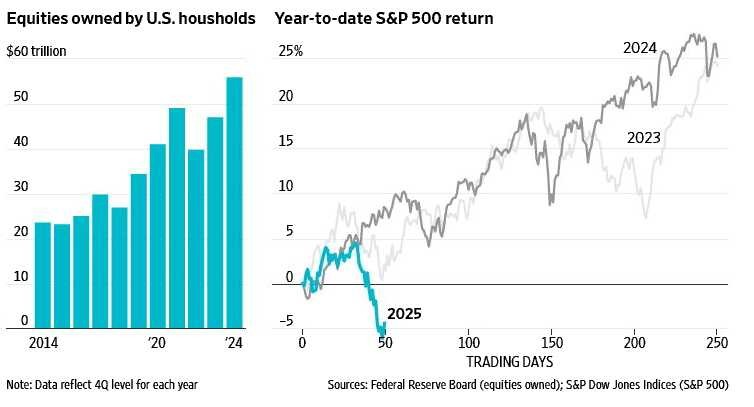

- The stock-market correction in recent weeks is more than a potential symptom of a slumping economy. It could cause a slump. After cheering President Trump’s election in November, the market has sunk as investors worry that the White House’s aggressive and fast-changing tariff war could scuttle a soft landing. On Thursday, the S& P 500 closed down more than 10% from its February high. It gained back some ground Friday.

- Falling stock prices could siphon the fuel out of two key engines of recent U.S. prosperity: robust spending by households and capital investment by businesses.

- With the Nasdaq down more than 10% from its high, the independent economist Phil Suttle worries that spooked executives could pull back from plans to spend an estimated $1 trillion on investment related to artificial intelligence in the years ahead.

Equity owned by U.S. Housholds

WSJ 3/17/25(Mon)

Inflation Cools Off, But Tariffs present a Threat

인플레이션 좀 식었지만, 관세가 여전히 위협

WSJ 3/13/25(Thu)

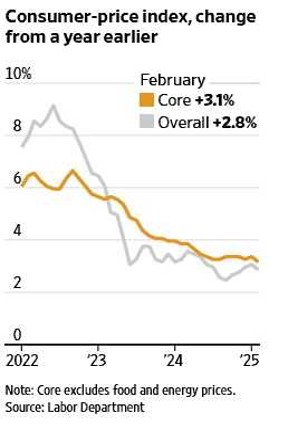

- Consumer prices were up 2.8% in February from a year earlier, the Labor Department reported Wednesday, versus a January gain of 3%. Economists polled by The Wall Street Journal had expected a 2.9% gain.

- Prices excluding food and energy categories—the so-called core measure that economists watch in an effort to better capture inflation’s underlying trend—rose 3.1%. That was the lowest year-over-year reading since 2021. It was also lower than the 3.2% economists expected.

- Wall Street is beginning to worry that the tariffs, in combination with actions by Elon Musk’s DOGE, could push the U.S. into a recession. Already, consumers are showing signs of anxiety. Consumer sentiment fell nearly 10% in the University of Michigan’s February survey. Consumer spending in January had its largest monthly drop in four years.

CPI dropped

WSJ 3/13/25(Thu)

Consumer Sentiment Sours

소비자 심리 지수 위축

WSJ 3/15/25(Sat)

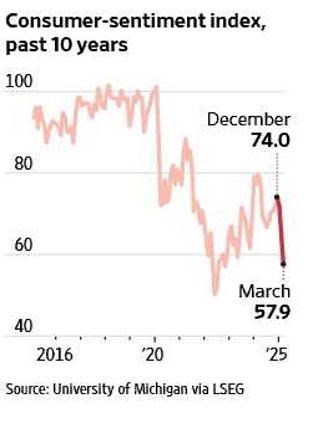

- Consumer sentiment in the U.S. sank this month, as worries intensify over what the tariffs, government layoffs, funding cuts and immigration restrictions that President Trump has introduced might mean for the economy.

- The University of Michigan’s closely watched index of consumer sentiment nosedived another 11% to 57.9 in mid-March from 64.7 last month, continuing a downward trend that has taken hold since Trump took office.

- That marked the lowest level since November 2022, and was much weaker than the 63.2 that economists polled by The Wall Street Journal expected. Compared with a year earlier, consumer sentiment is down 27%.

Consumer-sentiment index

WSJ 3/15/25

Rocket Agrees to Acquire Redfin

라켓 모기지사, 부동산 래드핀을 사들이기로

WSJ 3/11/25(Tue)

- Mortgage giant Rocket agreed to buy real-estate brokerage Redfin in a deal that values the target at $1.75 billion, the companies said Monday.

- The deal is expected to close later this year upon shareholder approval.

- Rocket envisions giving home buyers one place to connect with their real-estate agent, lender, title company and mortgage servicer, in an effort to streamline an often time-consuming and burdensome process.

- Zillowhas a similar goal. In 2022, the real-estate technology company said it was creating a “housing super app,” a platform on which consumers could navigate the entire moving process.

- The company has since rolled out a smoother process for buyers to connect with agents, home tours and mortgage financing in more than 40 markets.