Mortgage Interest Rates Review

United Mortgage Nation 7/9/2024

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 6.750 | 6.000 | 6.250 | 3.772 | 6.750 | 6.750 |

| A month ago | 6.999 | 6.250 | 6.249 | 4.491 | 6.999 | 6.999 |

| Last week | 6.999 | 6.225 | 6.375 | 4.479 | 6.999 | 6.999 |

| This week | 6.899 | 6.150 | 6.299 | 4.279 | 6.899 | 6.899 |

Federal Fund Rate: 5.25 -5.50% Prime Rate: 8.25 – 8.50%

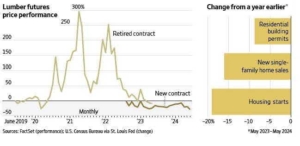

Home-Building Season Fails to Lift Lumber

건축 절기에도 불구, 목재 가격 하강

WSJ 7/1/24(Mon)

- Lumber prices have tumbled into building season, a sign that residential construction and home-improvement markets are buckling under high borrowing costs.

- Lumber futures shed 3% Friday to end at $452.50 per thousand board feet, down 27% since mid-March. Wood has piled up in the market and pushed cash prices even lower.

- Housing starts declined 17% between February and May, to a seasonally adjusted annual rate of 1.28 million, led lower by dwindling apartment construction. Meanwhile, building permits for new residential units fell in May to their lowest level since June 2020, when the pandemic boom was just revving up.

Lumber futures/Permits/Starts

WSJ 7/1/24

Downtown Office Buildings are Toxic, Suburban Ones are Surviving

WSJ 7/5/24(Fri)

- After years in the shade, humble suburban offices are faring better than glamorous city-center towers as home working continues to upend the property world.

- Downtown office valuations have halved from their peak in early 2022, based on MSCI Real Assets data. For suburban offices, the drop is a more manageable 18%. This is the opposite of what happened after the 2008-09 financial crisis, when prices for out-oftown offices fell slightly more than in major hubs.

- If rent no longer covers debt repayments, deep pocketed major investors are willing to walk away from their properties, triggering foreclosures. Meanwhile, suburban offices are more likely to be owne by smaller landlords or family offices.

Index of U.S. office values & Vacancy Rates

WSJ 7/5/24

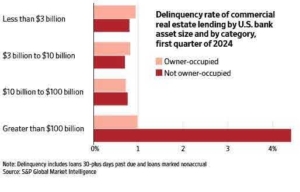

Big Banks Are Taking Hits From Commercial Real Estate

거대 은행도 상업용 융자로 영향을 받기 시작

WSJ 7/8/24(Mon)

- The trouble is at big banks and their loans to properties that are intended to be leased to third parties. For CRE loans involving properties that aren’t owner-occupied and are held by banks with over $100B in assets, more than 4.4% were delinquent in the first quarter. That was up over 0.3 percentage point from the prior quarter. Meanwhile, in each of the size categories of banks below $100B in assets, as well as for those bigger banks’ owner-occupied loans, the first-quarter rate was below 1%.

- Owner-occupied CRE loans tend to perform as long as the business doing the borrowing itself is healthy and able to make payments. Properties for lease, though, are far more sensitive to the level of interest rates. If the property’s income—affected either by the occupancy rate, or what the latest rents are—isn’t keeping up with what it now costs to pay the loan, then the loan can be problematic.

Delinquency rate of commercial real estate

WSJ 7/8/24

Expectation becomes high for FFR down in Sep

9월 금리인하 기대감 높아져

Korea Daily 7/8/24(Mon)

- While labor market in U.S. is cooling down, expectation for Fed Fund Rate decrease in Sep becomes high.

- Labor Department announced non-agriculture jobs increased 206,000 which is much lower than average increase(220,000) for the last 12 months.

- Unemployment rate increased to 4.1% in June from 4.0% in May, which was the highest since Nov 2022.

- According to Chicago CME, the probability for FOMC lower the FFR by 0.25% becomes 72.5% as of 5th while it was 68.4% a day before.

PCE in May hit 2.6% Up may cause FFR down

5월 물가지수 2.6% 상승에 그침, 금리인하 기대 상승

Korea Times 7/1/24(Mon)

- U.S. Department of Commerce announced on 28th that core PCE Index rose 2.6% in May from the same time year ago and 0.1% from a month ago.

- Core PCE has shown 2.8% consistently from Feb till April for 3 months. (PCE Index shows indicator of price level when consumers purchase service s and goods).

- The Fed is looking into PCE(Personal Consumption Expenditure) rather than CPI(Consumer Price Index) when they consider the monetary policy such as adjusting Federal Fund Rate.

U.S. 1st Qt GDP Growth only 1.4%

1분기 미 성장률 1.4%, 2022이후 가장 저조

Korea Times 7/1/24(Mon)

- U.S. Department of Commerce announced 1st Qt GDP growth is 1.4% from the previous Qt, which is lowest since 2Qt, 2022( – 0.6%). It shows clear contrast from 4th Qt 2023, which was 3.4% growth.

- Negative factor which caused lowering GDP is Import sector, 6.1% which was lower than forecast of 7.7%. Investment and Government Expenditure were adjusted upward to 4.4% from 3.3% forecast and 1.8% from 0.3% forecast respectively. Personal consumption was adjusted downward to 1.5% from 2.0% forecast.

- Among personal consumption, Service sector was adjusted to 3.3% from 3.9% forecast, Durable Goods adjusted to -4.5% from -4.1% forecast, and non-durable goods adjusted -1.1% from -0.5%.

China Approves Shanghai For Driverless Robotaxis

중국이 상하이에도 로보택시 시운전을 허가

WSJ 7/9/24(Tue)

- China has added Shanghai to a list of top-tier cities allowing the use of driverless robotaxis in which no safety supervisors are present, part of the country’s efforts to take a global lead in autonomous driving and commercialize the technology.

- Shanghai officials said over the weekend that in parts of the city, residents can now book free rides in robotaxis of four companies.

- Beijing, Shenzhen and Guangzhou have all started charging fees for the use of robotaxis in some cases, a step further toward commercializing autodriving in a country where dozens of companies are working on refining the technology and applying it on Chinese roads.

Beijing Leads U.S. in Fusion Race

중국이 “휴젼” 기술에서 미국을 앞서간다

WSJ 7/9/24(Tue)

- Fusion has long been a clean-energy dream. The process of combining atoms is the same process that powers the sun, and scientists hope to harness it to deliver almost limitless energy.

- China is outspending the U.S., completing a massive fusion- technology campus and launching a national fusion consortium that includes some of its largest industrial companies.

- Crews in China work in three shifts, essentially around the clock, to complete fusion projects. And the Asian superpower has 10 times as many Ph.D.s in fusion science and engineering as the U.S. The result is an increasing worry among American officials and scientists that an early U.S. lead is slipping away.