Mortgage Interest Rates Review

United Mortgage Nation 4/15/2025

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.250 | 6.620 | 6.499 | 4.628 | 7.250 | 7.250 |

| A month ago | 6.500 | 5.750 | 5.999 | 4.279 | 6.625 | 6.625 |

| Last week | 6.499 | 5.750 | 5.875 | 4.144 | 6.250 | 6.250 |

| This week | 6.750 | 5.999 | 6.125 | 4.409 | 6.375 | 6.375 |

Federal Fund Rate: 4.25 -4.50% Prime Rate: 7.25 – 7.50%

Smallest Businesses Hit Worst by Tariffs

관세장벽에 최대 피해자는 소기업들…

WSJ 4/14/25(Mon)

- Businesses of all sizes are struggling with President Trump’s new tariff regime, but small U.S. businesses are looking to be the biggest losers.

- Small and midsize companies account for $868 billion, or roughly one-third, of annual U.S. imports, according to the Census Bureau. And while they are dwarfed by global giants like Apple and Nike, these businesses also rely on overseas factories and Chinese goods that still carry steep tariffs.

- Sales are already slowing in response to tariff fears and economic uncertainty, some business owners say.

- Some businesses are turning to the courts for relief. Simplified, a small Florida company that specializes in appointment planners made from imported Chinese material, filed a lawsuit challenging Trump’s authority to impose the tariffs.

Trade Policies Darken Economic Forecast

관세정책이 경제 전망치를 어둡게

WSJ 4/14/25(Mon)

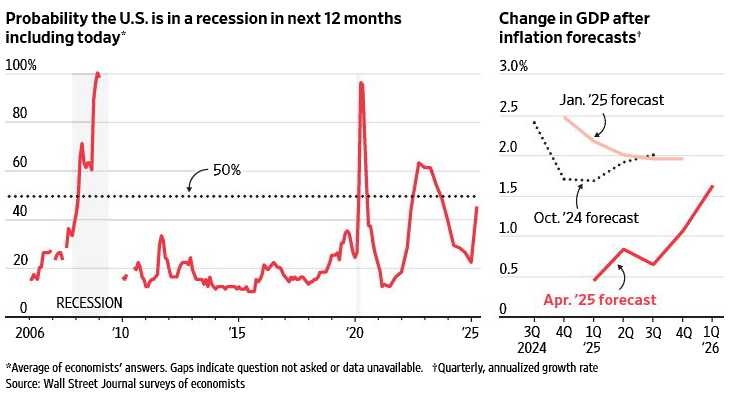

- What a difference three months makes. Since President Trump took office, economists have dramatically slashed estimates for growth while raising them for inflation and unemployment. The main reason, according to respondents to The Wall Street Journal’s quarterly survey of economists: tariffs.

- When the Journal last surveyed economists, from Jan. 10 to 14, they were unsure about many aspects of Trump’s policies, including tariffs, immigration restrictions and tax cuts. But they had to weigh that uncertainty against an economy that consistently outperformed expectations.

- Economists expect U.S. gross domestic product after inflation to expand just 0.8% in the fourth quarter from a year earlier, according to the survey’s average estimate. That is down from a forecast of 2% GDP growth in January. If accurate, it would make this year the economy’s worst since 2020, when Covid caused a brief but deep downturn. Economists expect 1.8% GDP growth in 2026.

Recession Probability & Change in GDP

WSJ 4/14/25

Trade War Threatens Home Values

관세전쟁이 주택가치도 영향줄수도

WSJ 4/14/25(Mon)

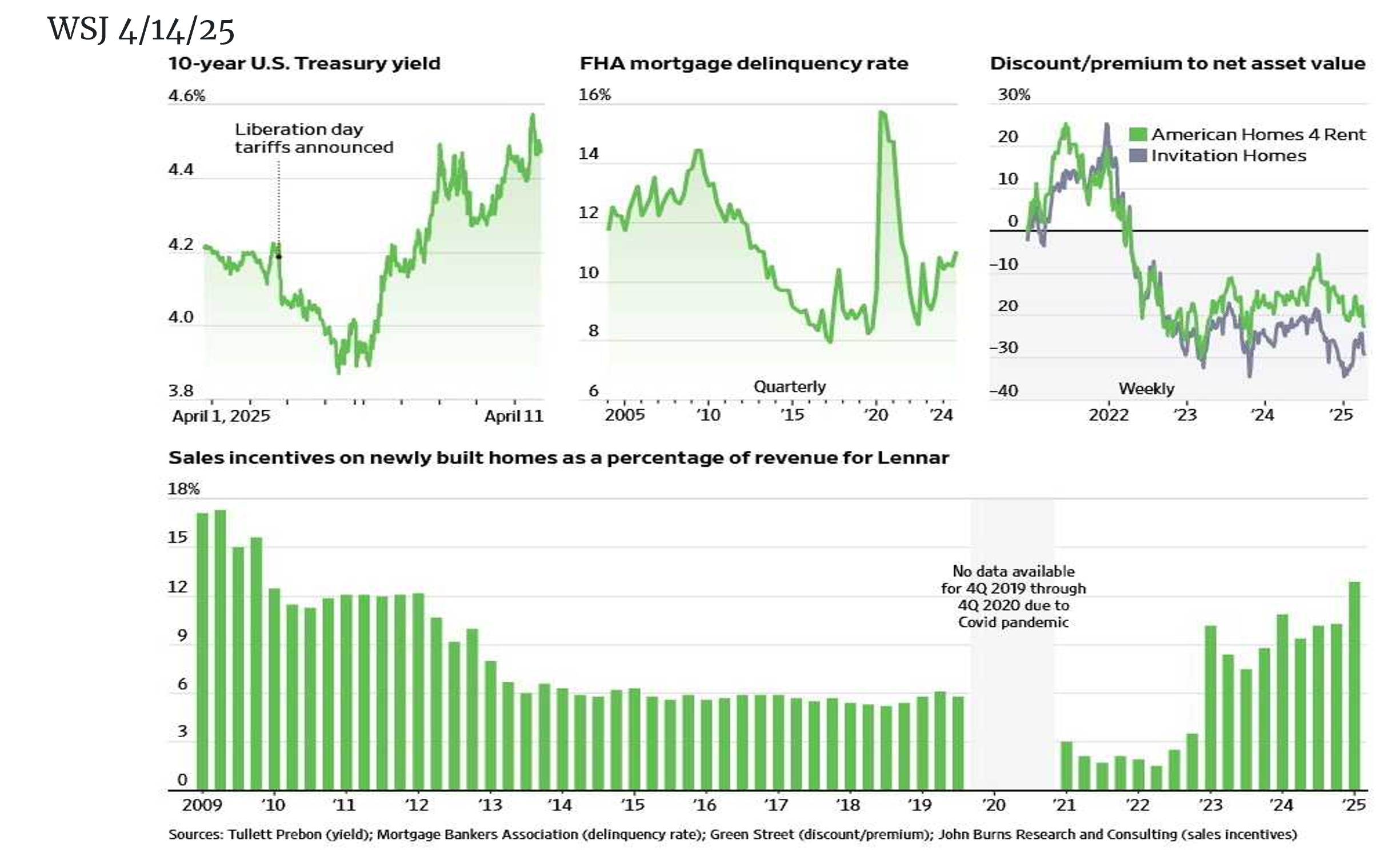

- Stock and bond markets gave President Trump an immediate thumbs down on his tariffs. A verdict on what the turmoil means for American home values will take longer to play out. On the one hand, an economic slowdown that leads to lower mortgage rates could make homes more affordable and boost demand from buyers. On the other, a recession is bad news for buyers if unemployment is rising. It’s even worse if there are widespread mortgage delinquencies that force some owners to sell.

- 10-Year Treasury Yield: The rates were rising last week, further muddying the housing waters. This was odd since investors usually buy haven assets like Treasuries when the probability of a recession increases. The unusual move may reflect worries that tariffs will prove inflationary and make it hard for the Federal Reserve to cut rates. Or it could be a more ominous sign that foreign investors are rethinking the safety of U.S. assets.

- Mortgage delinquencies :Missed mortgage payments are still low overall and owners have built up a lot of equity in their homes. But there are signs of trouble in one corner of the market. The delinquency rate on FHA mortgages has reached 11% according to the Mortgage Bankers Association. This is the highest level since 2013, stripping out a temporary spike during the pandemic. FHA loans cater to riskier borrowers who don’t qualify for a conventional mortgage because they have only a small down payment or weak credit. The loans also are a good proxy for the health of first-time buyers.

- Housing stocks :Shares of single-family housing REITs offer an immediate read of where investors think prices of American homes are heading. The stock market is currently pricing the portfolios of Invitation Homes and American Homes 4 Rent at a discount to what houses are changing hands for in the open market. This is a sign that investors think home prices are unsustainably high.

- Builders’ incentives :Home builders have more completed- but-unsold new homes sitting on their lots than at any time since 2009. They are offering sweeteners such as price cuts and mortgage-rate buydowns to shift them. Rick Palacios, director of research at John Burns Research and Consulting, says these incentives may give a purer signal about the state of demand than existing home sales.

- A regular seller can always delist their home if they don’t get the price they are looking for. Home builders can’t do this without taking a hit to sales volumes. So they will keep cutting the price until they find a market-clearing level.

- Usually, the incentives that home builders offer are equivalent to around 5% of the total value of a home, Palacios says. Today, the rate for some of America’s top builders like Lennar is 13%.

4 Metrics of housing price

WSJ 4/14/25

Electing to S Corp can save Gain Tax

부동산 임대전에 S Corp 로 등록: 절세 방안

Korea Daily 4/11/25(Fri)

- Capital Gain Tax can be exempted for married couple up to $500k when they sell the property if they lived in the property for 2 years during the last 5 years.

- If they give lease to tenant for rent income for more than 3 years, and then they want to sell the property, the exemption will ne nullified.

- In order to get benefit for Tax Exemption, the couple set up C Corp , and then elect to S Corp. And they can sell the property to S Corp via contract for deed or wraparound mortgage – property owner will sign for both seller and buyer, but it needs to be a bona fide sale.

- Source: Joo Han Moon, CPA. 347 977 0000 www.cpamoon.com