Mortgage Interest Rates Review

| 30 yr fx (%) | 15 yr fx (%) | FHA

(%) |

10 yr Tr Y (%) | 5 yr Arm (%) | 7 yr Arm (%) | |

| A year ago | 7.050 | 6.375 | 6.250 | 4.371 | 6.999 | 6.999 |

| A month ago | 6.625 | 5.625 | 5.999 | 4.199 | 6.625 | 6.625 |

| Last week | 6.625 | 5.875 | 5.999 | 4.247 | 6.250 | 6.250 |

| This week | 6.499 | 5.750 | 5.875 | 4.144 | 6.250 | 6.250 |

Federal Fund Rate: 4.25 -4.50% Prime Rate: 7.25 – 7.50%

Home Builders are Winners from Trump Tariff

주택공사업체, 관세전쟁하에서 유리한 상황

WSJ 4/7/25(Mon)

- Shares of home builders rallied Friday after Canadian lumber was spared from Trump’s tariff plans.

- Lennar gained more than 2% and PulteGroup rose more than 3%, trimming their declines for the week. Home builders may also be getting a boost from the prospect of a possible decline in mortgage rates.

- Those rates, which tend to rise and fall alongside long term Treasury yields, have remained elevated and kept prospective home buyers on the sidelines.

- Ten-year Treasury yields recorded their biggest two day drop in seven months Thursday and Friday.

- However, tariffs on other home-building supplies could drive up home prices and diminish any benefit from cheaper rates.

Rocket to Buy Big Mortgage Servicer

라켓, 모기지융자회사, Mr.Cooper를 인수 계획

WSJ 4/1/25(Tue)

- Rocket Cos. is looking to take an even bigger chunk of the mortgage market with the $9.4 billion acquisition ofMr. Cooper Group, one of the country’s largest servicers.

- The owner of Rocket Mortgage said Monday that it would exchange 11 of its Rocket shares for each share of Mr. Cooper, giving the latter company’s stock a deal value of $143.33 based on last week’s closing prices.

- Shares of Mr. Cooper jumped more than 14% to $119.60 Monday while Rocket shares retreated more than 7% to $12.07.

- The Detroit-based Rocket has said it is trying to create a one-stop shopping experience for home buyers that connects real-estate agents, lenders, title companies and mortgage servicers.

- Rocket also will acquire Redfin, the Real Estate Brokerage Co, this year.

Four Ways to Add Real Estate To Your Mix of Assets

자산관리에 부동산지산을 늘리는 4가지 방법

WSJ 4/8/25(The)

- Individual investors who want to diversify into real-estate investing have no shortage of options—from the direct, like purchasing a property to flip or rent out, to the indirect, such as real-estate investment trusts or crowdfunding syndicates.

- REITs

Publicly traded real-estate investment trusts, or REITs, are a low cost way for individual investors to gain access to a variety of property sectors—including residential, commercial, office, warehouse and institutional.

- Stocks

Another way to gain exposure to the real-estate sector without buying a property is to invest in publicly traded home builders, construction companies, suppliers and even home-improvement or furniture retailers.

- Shared ownership

Partnerships and syndicates allow investors to share the risk and returns of direct ownership without having to get their hands dirty.

- Private ownership

Buying a property to fix and flip or to rent is a common, yet high-risk and potentially high-return, endeavor. For one thing, capital appreciation or steady rent checks look great on paper, but any rise in property value is offset to some extent by improvements, maintenance, property taxes and insurance.

Yields Fall As Worries Mount Over Slowdown

경기완화걱정에 국채 수익률 하강

WSJ 4/5/25(Sat)

- The Trump administration wanted bond yields to fall. They just didn’t want it to happen like this.

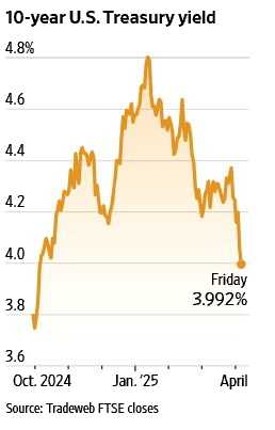

- Treasury yields, which fall when bond prices rise, have plunged over the past two days, reflecting deepening concerns that President Trump’s tariff policies could cause significant damage to what has been a strong U.S. economy.

- The yield on the benchmark 10-year U.S. Treasury note settled Friday at 3.992%, according to Tradeweb. That was down from around 4.8% in January, before tariff threats started weighing on sentiment, and roughly 4.2% on Wednesday, just ahead of the “Liberation Day” tariff announcement.

10-year U.S. Treasury Yield

WSJ 4/5/25

Market Turmoil Spreads Across Globe

주식시장 불안전, 전세계로 퍼져…

WSJ 4/8/25(Tue)

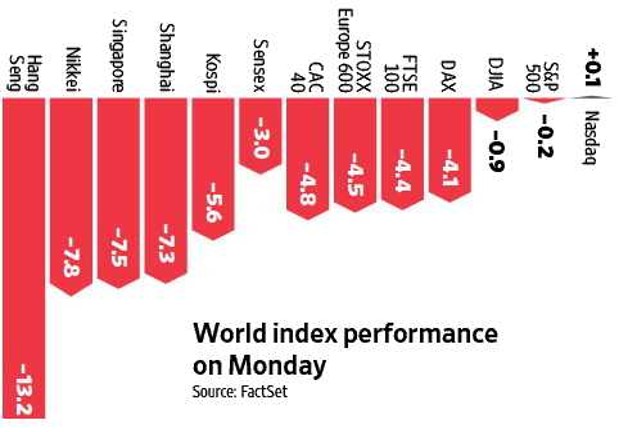

- U.S. stocks took a heavy beating for two days in a row last week. On Monday, it was the rest of the world’s turn.

- Trump actually escalated the trade war, saying Monday he planned to add an additional 50% tariff on China starting Wednesday if Beijing doesn’t withdraw its planned 34% retaliatory tariff increase on the U.S. Other countries across the globe were scrambling to see if they could negotiate a deal with the administration.

- On Monday, Japan’s Nikkei logged its biggest drop since last August. Hong Kong’s Hang Seng lost 13% in its largest one-day fall since the Asian financial crisis of 1997. France’s CAC 40 slid 4.8%, adding to its worst four-day stretch since the Covid meltdown. Even U.S. Treasurys sold off, a blow to investors who flocked to bonds for safety in recent days.

World index performance on Monday

WSJ 4/8/25

Wall Street Executives Warn of Dangers Of Tariffs

월가의 중역들, 관세정책의 위험을 경고

WSJ 4/8/25(Tue)

- Now, after a market meltdown that has erased trillions of dollars in value from U.S. stocks, some are speaking out, including those who have been vocal supporters of Trump.

- Bill Ackman, the billionaire hedge-fund manager, “We are in the process of destroying confidence in our country as a trading partner, as a place to do business, and as a market to invest capital,” Ackman wrote in a social-media post on X.

- U.S. stocks were volatile Monday and ended largely down again. The S& P 500 lost 0.2% and has now lost 10.7% in the last three days. The tech heavy Nasdaq Composite recovered and ended higher.

- “What’s going to happen to the markets, I can’t tell you,” Trump said late Sunday. “I don’t want anything to go down. But sometimes you have to take medicine to fix something.”